This post is part of a series that analyzes our wedding expenses. See also our Our Comprehensive List of All Wedding Expenses, The Cost of Getting Married vs. the Cost of our Wedding, Our Avoidable and Regrettable Wedding Expenses, The Overall Net Cost of Our Wedding, and Some Wedding Budget Lessons Learned

As part of my ongoing discussion this week about our wedding budget and expenses, today I’ll talk about the distribution of our wedding expenses. I realize that this is something extremely important for folks who are on tight budgets and are trying to figure out how to budget their regular monthly income for wedding expenses.

First up, our wedding consisted of 174 separate expenses (this may vary a bit from figures I mention in the future, because our “wedding expenses” spreadsheet also includes transactions such as refunds from things like, oh, missing wedding dresses, and returns of items I didn’t want. So, there are a few negative (-) figures included in our overall transactions. But for the purposes of this analysis, I’m just including postive (+) figures.

Also, you’ll note that this will affect the overall amount “spent.” These figures will appear higher than the amount I mentioned yesterday, because yesterday’s figure included ALL the wedding expense transactions, including refunds and returns. It’s just that the negative figures really affected the charts and graphs, so I decided not to include them.

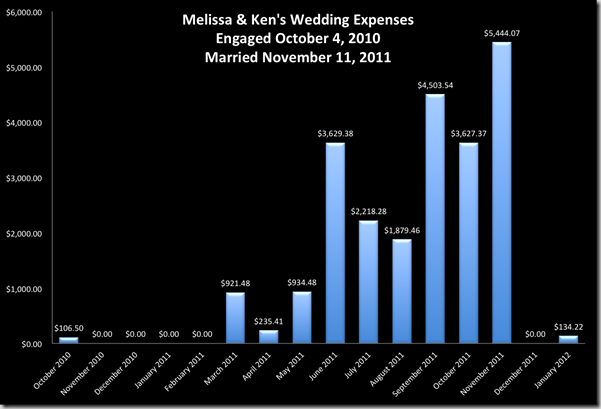

Wedding Expenses by Month

We had a 13 month engagement (engaged in October 2010, married in November 2011), so first up, let’s take a look at our wedding-related expenses by month:

As you can see, the wedding month itself was the most expensive month, but only by about $900 from the second most expensive month. Since we couldn’t apply to our wedding venue until March, and didn’t find out that our wedding date was confirmed until the last day of May, our wedding expenses for the first seven months of our engagement were fairly minimal and included wedding magazines and books, dance lessons, and some other random things. (Yet another reason why you can plan your wedding in a much shorter time frame than the traditional “it takes a year to plan a wedding” advice).

Our big spend months are pretty consistent with what I thought they would be. Our November 11 wedding date was confirmed on May 31st, so we sent out a bunch of deposits in June. And then in September, I was trying to finish 99% of wedding tasks two months before the wedding, so we spent a lot of money that month too.

(And just as an FYI, that $134.22 expense in January 2012 was for our thank you cards and stamps. I’ll be posting the comprehensive listing of ALL our expenses tomorrow.)

How this can help you if you’re on a budget and need to pinch your pennies?

So what do these figures mean for other couples planning their wedding? Well, of course every couple will be different, but in our circumstance, this is how we spent our total wedding budget by month:

We spent nearly 23%, or nearly one-quarter, of our total budget the actual month of the wedding. So, if you have a $10,000 wedding budget, you can expect that approximately $2500 of that will be spent the month of your wedding. Nearly 20% of the total was spent two months before the wedding, and 15% of the total was spent one month before the wedding (and another 15% of the total was spent five months before the wedding).

Here’s a quick reference table, based on our experience, of what percentage of your budget you can expect to spend during a 13 month engagement. Again, this isn’t universal, especially given our unique venue situation, but I hope it can still be useful.

| T-13 Months | 1% |

| T-12 Months | 0% |

| T-11 Months | 0% |

| T-10 Months | 0% |

| T-9 Months | 0% |

| T-8 Months | 4% |

| T-7 Months | 1% |

| T-6 Months | 4% |

| T-5 Months | 15% |

| T-4 Months | 9% |

| T-3 Months | 8% |

| T-2 Months | 19% |

| T-1 Month | 15% |

| Wedding Month | 23% |

| Post Wedding | 1% |

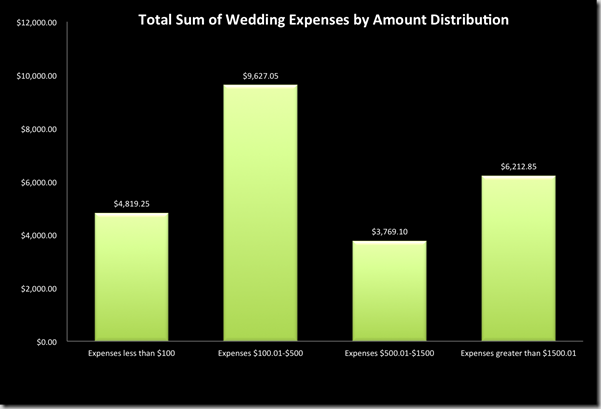

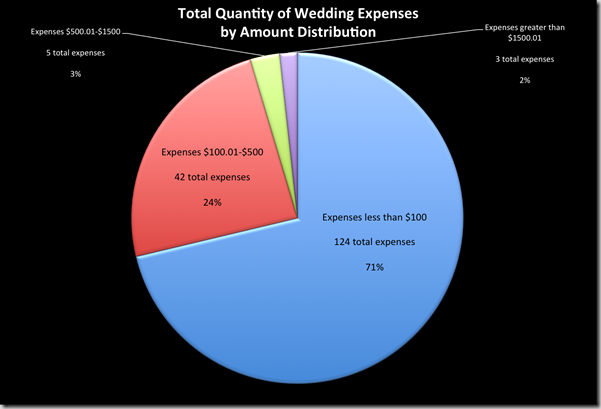

Distribution of Expenses by Amount

I’ve talked about our distribution of expenses before, and I thought it was a useful exercise. It helps illustrate that smaller wedding expenses add up to huge chunks. So, while categories listed on sites like Wedding Wire and The Knot include the major expense categories (catering, venue, photographer, attire, etc.), you also have to be keenly aware of those expenses that are less than $100. Because they add up like crazy!

So, I did some analysis of our expenses for the following categories:

- Expenses less than $100

- Expenses $100.01-$500

- Expenses $500.01-$1500

- Expenses greater than $1500.01

Now, a few caveats. Our wedding expense tracking spreadsheet (more on that tomorrow) lists out each individual expense. So, for instance, our catering deposit is a different line item than our catering balance, which is different than the catering tip (and different from the beer, wine, etc.) So yesterday, when I mentioned how our catering expenses (or, as we categorized it, our “food and beverage” expenses) was $3933.92, that was our TOTAL food and beverage expense. For the purposes of the distribution of expenses, I’m accounting for each individual line item such as deposits vs. balances.

Another caveat: like the above analysis, I’m not including transactions from our wedding expense spreadsheet that were negative, such as refunds and returns. Therefore, not including those negative transactions, we had a total of 174 expenses.

Here goes:

- 124 expenses less than $100 that added up to $4819.25

- 42 expenses $100.01-$500 that added up to a whopping $9,627.05

- 5 expenses $500.01-$1500 that added up to $3769.10

- 3 expenses greater than $1500.01 that added up to $6212.85 (Our biggest single expense was $2910 when we paid our wedding photographer in full after we negotiated a $150 discount for paying the full balance up front)

When I looked as these figures, I was completely flabbergasted! All of those “less expensive” items (i.e., less than $500) accounted for TWO-THIRDS of our wedding expenses! It wasn’t our “expensive photographer” or renting our wedding venue for three days instead of just one or two that broke the bank. It was all those “small” expenses of less than $500 that completely killed our budget!

How this can help you budget for your wedding expenses

Figure out what your individual “big ticket” expenses will be (i.e., expenses greater than $500) and add all those up together. Using our wedding as an example, you can expect that the sum of all those “big ticket” expenses will be approximately 40% of your budget. The remaining 60% should be set aside for expenses less than $500, that often can’t be anticipated.

For example, let’s say you added up all your estimated “big ticket” expenses, and that figure added up to $4000. You can likely estimate that you will spend another $6000 (60% or approximately two-thirds) of your budget on additional expenses that cost less than $500. If your wedding budget is $10,000, then you’re in good shape! If your budget is only $7500 though, then you’re unfortunately well-positioned to go over your budget.

But there is hope!

You can learn from our wedding! You can be very careful about what you spend money on that is less than $500, or heck, even less than $100. In a few days I’ll talk about what expenses we could have avoided for our wedding, so maybe that will help illustrate it a bit more, but just be very wary of those little expenses that add up to such significant amounts. You know what costs less than $100? DIY supplies, thrift store vases, table number holders, cake toppers, cute little chalkboards, stamps, and tons of other items. So, even though I thought I was saving money by buying things from, for instance, the thrift store, those expenses still added up significantly!

How about you all? Were your expenses distributed similarly? Any additional distribution analysis you would like to see?