Ken and I have begun the process of combining our finances now that we’re married. Although we lived together for nearly three years before we got married, we always kept our financial accounts separate, but we had a monthly ritual of determining all our shared expenses.

How we share our expenses currently

Let’s start with how we currently figure out our shared finances. We’ve been using this process since we first moved in together.

We share a spreadsheet on Google Docs called "Shared Expenses" (original, I know!)

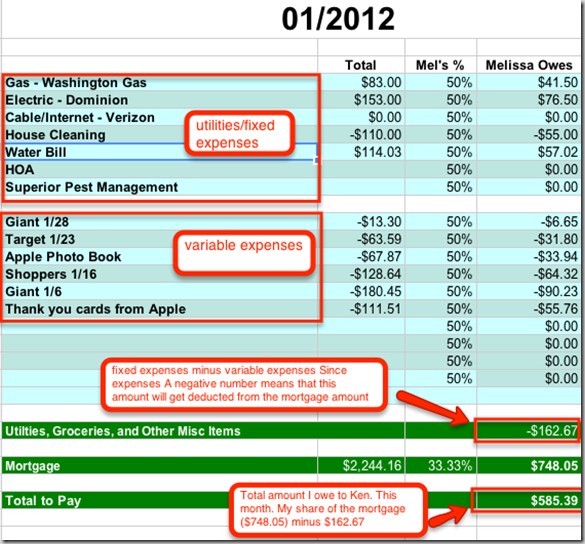

At the end of every month, we enter expenses we consider to be "shared" into the spreadsheet. For the most part, we split all shared expenses 50/50. The only exception is the mortgage. When Ken and I moved in together, we agreed that I would contribute to a third of his mortgage instead of half, since he makes significantly more money than me. This is a screenshot of last month’s shared expenses. (Expense amounts that are preceded by a negative (-) sign are expenses that I paid.)

The top portion are the expenses that are generally fixed. Cable bill, house cleaning, water bill, etc (the mortgage amount is listed at the very bottom). Ken usually pays all the fixed expenses except for the house cleaning.

The bottom portion contains expenses that are not fixed. These are expenses that are typically incurred by me, since I do most of the household shopping. However, there are occasions when Ken has line items to add to the non-fixed expenses. I enter all my expenses as negative numbers because that amount, in essence, gets “subtracted” from what I owe. (Typically I owe Ken money because the non-fixed expenses rarely exceed the fixed expense amount since my portion of the mortgage is $748 alone. Although for a couple of months when wedding expenses were quite high, there were times when Ken owed me money at the end of the month).

Then, whatever the total amount adds up to, I transfer that amount from my primary checking account to the Joint Checking account we had set up solely for the purpose of our shared expenses. Then Ken transfers that money from the joint checking account to his personal checking account.

It has worked beautifully for three years.

If it ain’t broke, why fix it?

In the near future, Ken and I are going to combine are checking accounts. But why should we do that, if the shared expenses tracking works out well?

Well, there are a few reasons.

- Plain old simplicity’s sake. Between the two of us, we have three checking accounts. Mine, his, and the joint checking we set up solely for the purpose of transferring our shared expenses.

- Although the shared expenses spreadsheet is very straightforward, it does take time at the end of every month to go back through all of my expenses and determine how much money I spent at the supermarket or on our plane tickets for an upcoming trip. It’s 20 minutes spent every month that can be spent on something else.

- I just think it’ll be nice to have one, shared account so that we can more effectively track our finances as we move forward in our marriage.

Since our new joint account will actually be Ken’s current personal checking account, most of the burden is on me to make sure my accounts are in order before I begin, for instance, direct depositing my paycheck into his account and beginning to pay bills from that checking account. This is taking quite a bit of time, but here’s what I’ve been doing.

Making a list of every account that has my checking account number linked to it so that I can change it. This is mostly for the purposes of paying accounts online. This is fairly straightforward because I maintain a master list of all my 20 credit cards, but here are some other things that have made it on my list, including other accounts like:

- Paypal

- Student Loan accounts

- Utility bills (although since Ken pays most of those through his account, I don’t have to worry about that one as much, except for my cell phone)

- Direct Deposit

- Monthly investment contributions (to Roth IRA, brokerage accounts, etc.)

Am I missing anything?

For probably at least the first six months of the transition, I’m going to keep a decent chunk of money in my current personal checking account (maybe $2000 or so) to make sure that any direct debits from my checking account that I may have missed won’t overdraft that account. I use credit cards for all of my day-to-day expenses, so I’m not too worried about things like getting a new debit card right away, and we can just use Ken’s checkbook until I get checks in my name for that account (you know, for the like 10 checks total I write every year).

I also have a slight fear of not knowing for sure how long it takes for changes to checking payment accounts to take effect. For instance, if I change the checking account number so that my student loan payment now debits from Ken and I’s new joint account, would that go into effect the very next day? The next week? The next month?

Anyway, my point is just that I don’t want to cause any financial headaches during the transition. Or at least try to minimize them.

We’ll be getting started within the next few months combining our accounts! I keep detailed financial spreadsheets, including two spreadsheets I complete at the end of every month, in addition to the shared expenses spreadsheet, called "Financial Portrait" (which is basically a net worth statement) and my monthly cash flow statement. It’ll be fun to fine tune all of the spreadsheets for our new shared financial future! Ken knows all about my spreadsheets, so I hope he won’t find it to be a complete hassle.

I’ll be sure to let you know how things progress.

How about you all? Do you share joint financial accounts? Did you make the transition before or after you got married? How did you share expenses when you were living together?